Congratulations Coinllectibles!

For those who missed it, Coinllecitbles eclipsed value expectations in its latest NFT Fusion Antique sales

Like ourselves, Coinllectibles understand how blockchain technology can be imbued into antiques to enhance their value, look at their portfolio’s relisting prices!

If you’re interested in acquiring your own phy+gital fusion antiques, or perhaps offering a digitally-twinned versions alongside your physical item sales, then please do not hesitate in getting in touch.

kpp@studioNFT.xyz

Ted Talks on NFT

TED is dedicated to researching and sharing knowledge that matters through short talks and presentations. Their goal is to inform and educate global audiences in an accessible way.

Watch technologist Kayvon Tehranian explore why NFTs are a technological breakthrough. Learn how NFTs are putting power and economic control back into the hands of digital creators -- and pushing forward the internet's next evolution (Aug21).

A hedonic valuation perspective on NFTs

The second way to look at NFTs is through its hedonic value. There’s a 2012 paper that examines this idea as it relates to World of Warcraft and in-game items. A player was given a shield from her friend. This shield is actually a pretty common item, but the player didn’t want to drop, destroy, or sell the shield. In her mind, even if she could easily buy the same shield, its value won’t be the same as the gifted one.

I like this example because it clearly outlines the hedonic elements of digital scarcity. It matters to the player where she got the shield. For most digital things, like money, this intrinsic, hedonic value wouldn’t make sense. With NFTs, things that were once treated as interchangeable on the digital space, like a gifted shield or a virtual collectible, are allowed to exist with this added value that is appealing to a buyer or owner.

The hedonic aspect of value seems very abstract, which is probably why people don’t mention it as much as the functional approach. What stuck out to you about this idea of hedonic value?

I would say there’s even a hedonic approach to the idea of provenance, which a lot of artists and NFT creators emphasize. There’s this story about the Mona Lisa, how it was once hung on Napoleon’s bedroom wall, and the painting’s history and association with him brought it great cultural value.

I’m going to drop a very jargony word here, which is called “biographical indexicality.” In the theory of collectibles, the idea is that people like collectibles because they have some sort of biographical element that indexes some important events in the past or its relation to a person’s life in history. The fact that this notion is being applied in the digital space through NFTs is just really exciting to me.

The Law Commission & smart contracts

The issue

Emerging technologies such as distributed ledgers are being promoted as a way to create “smart contracts”: computer programs which run automatically, in whole or in part, without the need for human intervention. Smart contracts can perform transactions on decentralised cryptocurrency exchanges, facilitate games and the exchange of collectibles between participants on a distributed ledger, and run online gambling programs. They can also be used to record and perform the obligations of a legally binding contract. It is this second category of smart contracts (sometimes referred to as smart legal contracts) which is relevant to our work. When we talk about smart contracts in this project we are therefore talking about legally binding contracts in which some or all of the terms are recorded in or performed by a computer program deployed on a distributed ledger. Smart contracts may take the form of a natural language contract where performance is automated by computer code, a hybrid contract consisting of natural language and coded terms or a contract which is written wholly in code. Smart contracts are expected to increase efficiency and certainty in business and reduce the need for contracting parties to have to trust each other; the trust resides instead in the code.

To ensure that the jurisdiction of England and Wales remains a competitive choice for business, there is a compelling case for reviewing the current legal framework in England and Wales to ensure that it facilitates the use of smart contracts. There are questions about the circumstances in which a smart contract will be legally binding, how smart contracts are to be interpreted, how vitiating factors such as mistake can apply to smart contracts, and the remedies available where the smart contract does not perform as intended. The nascent state of the technology means that there are few, if any, tested solutions to the legal issues to which smart contracts give rise.

The legal status of Digital Assets

The problem

Digital assets are increasingly important in modern society. They are used for an expanding variety of purposes, including as means of payment for goods and services or to represent other things or rights, and in growing volumes. Cryptoassets, smart contracts, distributed ledger technology and associated technology have broadened the ways in which digital assets can be created, accessed, used and transferred. Such technological development is set only to continue.

Digital assets are generally treated as property by market participants. Property and property rights are vital to modern social, economic and legal systems and should be recognised and protected as such. While the law of England and Wales is flexible enough to accommodate digital assets, certain aspects of the law need reform to ensure that digital assets are given consistent recognition and protection.

For example, the law recognises that a digital asset can be property and that a digital asset can be “owned”. However, it does not recognise the possibility that a digital asset can be “possessed” because the concept of “possession” is currently limited to physical things. This has consequences for how digital assets are transferred, secured and protected under the law.

Reforming the law to provide legal certainty would lay a strong foundation for the development and adoption of digital assets. It would also incentivise the use of English and Welsh law and the jurisdiction of England and Wales in transactions concerning digital assets.

This work described on this page is linked to our proposals for the digitalisation of trade documents such as bills of lading and bills of exchange, which also require to be “possessed” in the eyes of the law.

Need help visualising the metaverse?

“The simplest way to define the metaverse is as an evolution of how users interact with brands, intellectual properties and each other on the Internet. The metaverse, to Sweeney, would be an expansive, digitized communal space where users can mingle freely with brands and one another in ways that permit self-expression and spark joy. It would be a kind of online playground where users could join friends to play a multiplayer game like Epic’s “Fortnite” one moment, watch a movie via Netflix the next and then bring their friends to test drive a new car that’s crafted exactly the same in the real world as it would be in this virtual one. It would not be, Sweeney said, the manicured, ad-laden news feed presented by platforms like Facebook.

“The metaverse isn’t going to be that,” Sweeney said. “A carmaker who wants to make a presence in the metaverse isn’t going to run ads. They’re going to drop their car into the world in real time and you’ll be able to drive it around. And they’re going to work with lots of content creators with different experiences to ensure their car is playable here and there, and that it’s receiving the attention it deserves.”

Read more here

You can borrow against an NFT?

It all begins with an idea.

NFTfi is marketplace for NFT collateralised loans. As you might have guessed, it enables users to put their NFT assets up as collateral for a loan, or offer loans to other users on their non-fungible tokens.

Borrowers can put any ERC-721 token (i.e. the NFTs available on this site) up for collateralization. On accepting a loan offered by another user, ETH is automatically paid out from the lenders account to your own, and your NFT gets locked in the NFTfi smart contract. Once you repay the loan, the asset is transferred back to you. Otherwise, if you don’t pay the total repayment amount before the due date, the NFT is transferred to the lender.

But what about the physical asset backed NFTs?

We’re working on it.

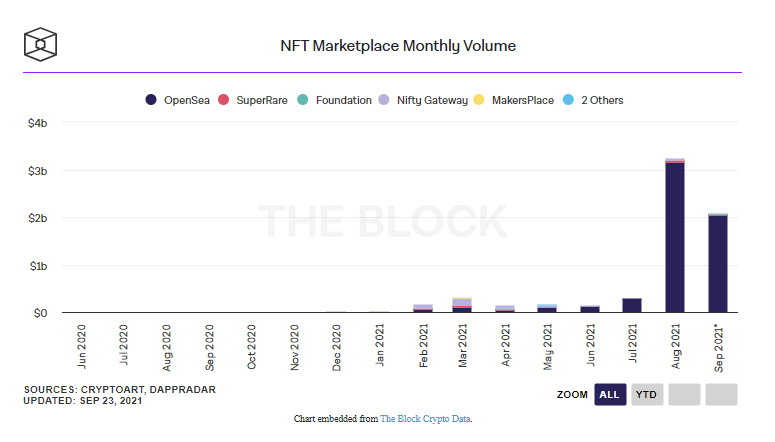

How big is the NFT market right now?

It all begins with an idea.

But we believe the future dominant marketplace will offer more than the current incumbents and decentralised, like SushiSwap’s soon to launch NFT marketplace, Shoyun.

Some interesting features that will be offered by Shoyun include:

– Immersive Gallery & 3D Metaverse

– Social Token

– On-chain & off-chain exchange

– Bidding strategies

– Royalties distribution

– Fractional ownership

– Multi-chain support